When it comes to investing, Fidelity simplifies the endeavor with commission-free pricing and a very easy-to-use platform. Along with the extensive stock research they make available at your fingertips, getting the latest educational support could not be easier.

A longtime leader of excellence in the industry, their name is trusted and synonymous with offering great services, simplicity, and affordability in stock trading.

That's why we rank Fidelity as one of our best online stock brokers. We also use Fidelity in for ourselves (learn what other tools we use here). With their commission free pricing, 0.00% expense ratio mutual funds, and great customer service, they're one of the best places to invest.

Fidelity Investing Details | |

|---|---|

Product Name | Fidelity |

Min Invesment | $0 |

Commissions | $0 for Stock, Options, and ETF trades |

Account Type | Taxable, IRA, Trust, and More |

Promotions | None |

What Does Fidelity Offer?

Fidelity is a full-service broker that can meet the needs of virtually every investor or trader. Here's what they have to offer.

In 2023, Fidelity was also named our top pick for online brokerages in our annual reader survey, specifically because of their robust options and low pricing. See our full list of the best stock brokers here.

They were also named a Top investing App.

Low Costs

Fidelity offers commission-free pricing of stock, options, and ETF trades. Plus, Fidelity is the only brokerage (currently) that offers 0% expense ratio mutual funds. This puts them slightly ahead of the other big names in the space, such as Vanguard or Schwab.

Fidelity also offers over 3,400 no-transaction-fee (NTF) mutual funds. That's one of the largest collections of NTF funds that you'll find anywhere.

Another perk of Fidelity is that many of their accounts require $0 minimum to open - such as any IRA or education savings account. If you combine this with no-cost investing in ETFs, you have a very inexpensive portfolio.

Easy-To-Use (Yet Powerful) Platforms

As a trading platform, Fidelity offers trading options through its website, apps, and Active Trader Pro for desktop. Boasting simplicity in navigation, with a range of comprehensive offerings, it's a seriously user-friendly service.

The Active Trader Pro service is offered to customers who qualify, meaning those who trade at a minimum of 36 times within a rolling 12-month span. Securities such as stocks, bonds, options, ETFs, mutual funds and Forex are tradable through their platform.

Additionally, Fidelity’s impressive mobile app platform offers the same advanced features available on desktop and gives customers access whenever they need it. It has the added benefits of offering quotes in real-time, multi-leg options trading, and even Fidelity’s research sector in a scaled-down, mobile-friendly format, making it a highly versatile tool to have on your smartphone or tablet.

Some platforms and tools it offers are restricted to only high-volume traders, however, such as the Active Trader Pro. Certain charting tools are available exclusively to those who place more than 120 trades per year. And their Wealth-Lab Pro feature limits access to a minimum of 36 trades per year, and traders must have a minimum in assets of $25,000.

Fractional Shares

Fidelity also offers fractional share investing - meaning that you don't need to buy a whole share of a company to invest. That is great for people looking to get started investing with just a little bit of cash! With Stocks by the SliceSM, you can invest as little as $1 in over 7,000 stocks and ETFs.

Robo-Advisor Portfolios

Fidelity's robo-advisor service is called Fidelity Go® and it's highly competitive. There are no account minimums and clients with balances below $10,000 don't pay any fees. Accounts below $50,000 pay $3 per month and clients with more than $50,000 in assets pay 0.35% per year.

If you have less than $50,000 to invest, you'll be hard-pressed to find a lower-cost robo-advisor option than Fidelity Go®. However, investors with larger accounts could save in management fees by choosing other robo-advisors like Betterment and Wealthfront (both of which start at 0.25%).

Vanguard's Digital Advisor undercuts both of those companies by charging just 0.15%, but there is a $3,000 account minimum. And Vanguard's Personal Advisor Services, which has a $50,000 minimum balance and combines robo management with support from human financial advisors, starts at 0.30%

See how Fidelity compares using our Online Stock Broker Comparison Tool.

Helpful Tools And Resources

Their highly detailed, extensive investment research is conducted by more than 20 different, independent third-party research firms, and offers reports on more than 4,500 stocks.

Screen strategies for researching stocks, options, and ETFs that have been organized by independent third party experts are offered. These can also be used to create your own custom screens with the available 140 unique filters. This feature is one of their best, and for those who are interested, Fidelity offers a free 30-Day Research trial.

Additionally, Fidelity offers real-time monitoring lists which enable one to track the stocks of interest. An array of notifications are available through their email service and especially through their mobile apps, which can be set accordingly if you would like to receive alerts on trade notifications, balance updates, market news, or areas of stock research.

Fidelity HSA®

The Fidelity HSA® (Health Savings Account) is a brokerage account that gives you flexibility with your health savings dollars.

The account has no monthly account fees and no minimum balance required to open the account.

Fidelity offers a wide range of investments , including stocks and bonds, mutual funds, and ETFs all commission-free⁵. You can also invest in fractional shares.

You can easily add funds to your Health Savings Account by transferring from a bank account, or mobile check deposit. And if you're looking to use your HSA for qualifying expenses, you can use the Fidelity HSA debit card or Fidelity BillPay.

Read our full Fidelity review here.

Fidelity® Youth Account

The Fidelity® Youth Account is a teen saving, investing, and spending account. It's an easy-to-use account for your teen, where you can invest with no monthly fees or account minimums!

You can invest in stocks for as little as $1 with fractional shares². Your teen can learn to save and spend smarter with their own debit card with no domestic ATM fees³. And teens can link their account to common payment apps like Venmo and PayPal⁴. Plus, parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations and debit card transactions.

Bonus Offer: Right now, open a Fidelity® Youth Account for your teen, and Fidelity will give your teen $50 into their account¹. This offer is available for a limited time and Fidelity reserves the right to terminate the offer at any time. The Fidelity Youth Account can only be opened by a parent/guardian. Account eligibility limited to teens aged 13-17.

Fidelity Crypto

Fidelity recently announced that they would be supporting cryptocurrency investments on their platform. Right now, you can opt-in to the waitlist to get access to cryptocurrency on Fidelity.

To start with, Fidelity will only be supporting Bitcoin (BTC) and Ethereum (ETH). Also, it will be very similar to how Robinhood handles crypto in that you don't actually hold any actual cryptocurrency, you cannot send and receive crypto to your account at Fidelity, and you won't have a crypto wallet to transact in Web3 with.

If you want to get access to BTC and ETH price movements in your Fidelity account, this can be a good choice. However, if you want to use cryptocurrency for payments, to access Web3 projects like NFTs, or to be more decentralized, you'd likely want to go with a true cryptocurrency exchange.

Fidelity® Rewards Visa

One of the biggest perks of Fidelity is using their Fidelity Rewards Visa to get cashback into your investment accounts. You can get 2% cashback rewards on everything you spend on the card! Plus, the card as no annual fee!

You can get your 2% cashback deposited into the following accounts (sadly, not your 401k):

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Charitable Giving Account

- Health Saving Account (HSA)

- Brokerage Account

- Fidelity-Managed 529 College Savings Accounts

You can deposit your cashback rewards in up to 5 qualifying accounts (but most people simply stick with one and keep it simple). Remember, cashback deposits do count towards annual contribution limits - so if you deposit into an IRA or HSA, be aware.

Benefits For Large Accounts And Service Levels

Fidelity does offer some benefits for large accounts, better than some brokers, but not as generous as others. With their drop to $0 commissions, one of the best perks (discounted trades) went away.

Fidelity has two main service levels: Fidelity Premium Services and Fidelity Private Client.

Fidelity Premium Services

At $250,000 in assets at Fidelity (including taxable brokerage, IRA, and retirement plans), you can qualify for Fidelity Premium Services. In some cases, you can and your spouse can hit that combined.

With Fidelity Premium Services, you get a separate customer service phone number of allegedly more experienced customer service representatives. You also get a dedicated advisor, you'll see their little picture and info in your Fidelity Dashboard on the top right.

What's helpful about this is that you can call or email them directly and get questions answered. They also may be able to help streamline paperwork as needed.

Finally, outgoing wire transfer fees are waived.

Fidelity Private Client

At $1,000,000 in assets at Fidelity, you get Fidelity Private Client status. While not much is different than Premium Services, you do get a dedicated rep and allegedly even better customer service (another dedicated line with even faster queue). In past years, they've provided free TurboTax to customers.

If you're a Wealth Management Client, you can also get an extra cash back bonus on your Fidelity Credit Card. While the baseline is 2% cash back, it can go as high as 3% cash back for Private Client members.

Are There Any Fees?

As already highlighted, Fidelity doesn't charge any trade commissions on stocks, ETFs, options. And it has 3,400+ NTF mutual funds, a few of which of also have expense ratios of zero. U.S. Treasury trades are also free when made online.

It does, however, charge a per-contract fee on options of $0.65. There's also a $1 fee for bond and CD trades.

For basic accounts, Fidelity does not have any account opening, transfer, or closure fees. Here are the fees that it charges for its Fidelity Go® robo-advisor service:

- Under $10,000: $0

- $10,000–$49,999: $3 per month

- $50,000 and above: 0.35% per year

Margin rates range from 4.00% to 8.325% as of December 2021, which sadly, are some of the highest in the industry. However, if you have a large portfolio, these are negotiable.

How Does Fidelity Compare?

Fidelity is consistently listed on our best places to invest. With commission-free trading, some 0% expense ration mutual funds, and the full range of investment options, you won't find much better out there.

Check out this quick comparison here:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Banking? | |||

Cell |

How Do I Open An Account?

You can visit Fidelity's website to get started. All accounts can be opened online and should only take a few minutes. Check out our video about how easy it is to open a Roth IRA at Fidelity:

Is It Safe And Secure?

Yes, Fidelity employs the latest security measures (including SSL encryption) to protect its clients' data. It also offers two-factor authentication and voice recognition technology. And Wealth Management clients receive complimentary identify theft protection through a third-party provider.

In addition to SIPC protection (up to $500,000), clients with Fidelity brokerage accounts receive an additional $1.9 million of "excess of SIPC" coverage. Clients with cash management accounts, meanwhile, receive FDIC deposit protection of up to up to $1.25 million across multiple banks.

How Do I Contact Fidelity?

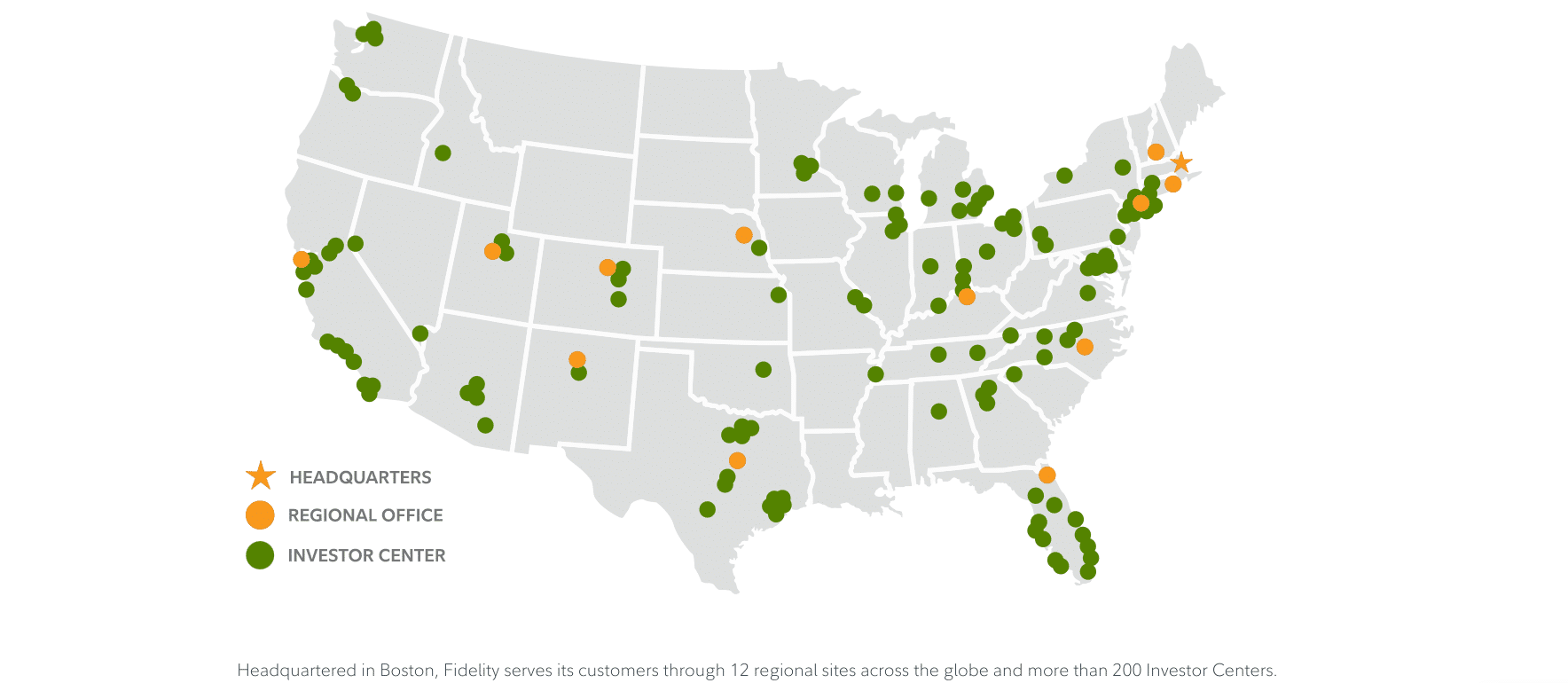

Fidelity can be reached at 800-343-3548 for personal accounts or 800-835-5095 for employer-sponsored accounts. You can also get in touch by email (after you log in to your account) or live chat. Or if you would prefer to speak to someone in person, they have over 200 Investor Centers.

Fidelity’s commitment to customer service is worth mentioning. Phone support is available 24/7. They also offer countless services geared towards educating and informing the customer. For example, they offer seminars in their locations regularly and webinars through their online learning center.

Is It Worth It?

For serious investors looking for maximum versatility online, Fidelity offers a wide range of benefits that can work for those who are looking for the best rates, free commissions, a wealth of research, a solid level of customer service, and state of the art tools that get the job done.

Overall, they provide a great service to those who want simplicity, low rates per trade, mobile accessibility, and in-depth research. They are by far the best for long-term investors, but short-term traders may find shortfalls.

Fidelity FAQs

Let's answer a few common questions about Fidelity:

Where is Fidelity's headquarters located?

Fidelity Investments main corporate office is located in Boston, Massachusetts. Its headquarters address is 245 Summer St, Boston, MA 02210.

Does Johnson & Johnson (J&J) own Fidelity?

No, J&J and Fidelity Investments are unrelated companies. However, Fidelity is owned by FMR LLC, which is controlled by a family with the last name of Johnson. Abigail Johnson has been president of Fidelity Investments since 2014.

How much money does Fidelity have under management?

As of July 2021, Fidelity had 37 million individual customers and managed $10.4 trillion in customer assets.

What bank does Fidelity use?

Fidelity's debit cards are issued by PNC Bank and the debit card program is operated by BNY Mellon Investment Servicing Trust Company. For accounts above $250,000, cash is swept to multiple banks to maximize FDIC insurance of up to $1.25 million.

Does Fidelity have any bonus offers or incentives?

No, Fidelity isn't currently offering cash bonuses or any other exclusive perks to new clients.

Fidelity Features

Account Types |

|

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions | $0 |

ETF Commissions | $0 |

No-Transaction-Fee (NTF) Mutual Funds | 3,400+ |

Options Costs |

|

Basic Account Fee | $0 |

Fidelity Go® Advisory Fee |

|

Margin Rates | 4.00% to 8.325% (as of December 2021) |

Banking Services | Yes |

Customer Service Number | Personal accounts: 800-343-3548 Employer-sponsored accounts: 800-835-5095 |

Customer Service Hours | 24/7 |

Mobile App Availability | iOS and Android |

Promotions | None |

Disclaimers

¹Limited Time Offer. Terms Apply. Before opening a Fidelity Youth Account, you should carefully read the account agreement and ensure that you fully understand your responsibilities to monitor and supervise your teen’s activity in the account.

²Fractional share quantities can be entered out to 3 decimal places (.001) as long as the value of the order is at least $0.01. Dollar-based trades can be entered out to 2 decimal places (e.g. $250.00).

³Your Youth Account will automatically be reimbursed for all ATM fees charged by other institutions while using the Fidelity® Debit Card at any ATM displaying the Visa®, Plus®, or Star® logos. The reimbursement will be credited to the account the same day the ATM fee is debited. Please note, for foreign transactions, there may be a 1% fee included in the amount charged to your account.

⁴Venmo is a service of PayPal, Inc. Fidelity Investments and PayPal are independent entities and are not legally affiliated. Use a Venmo or PayPal account may be subject to their terms and conditions, including age requirements.

⁵$0.00 commission applies to online U.S. equity trades, exchange-traded funds (ETFs), and options (+ $0.65 per contract fee) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an Options Regulatory Fee that applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See [Fidelity.com/commissions) for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Institutional® are subject to different commission schedules.

Fidelity Review

-

Commissions & Fees

-

Customer Service

-

Ease Of Use

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Fidelity provides a great service to those who want simplicity, commission-free trades, mobile accessibility, and in-depth research.

Pros

- Commission-free investing

- Access to every account type, including HSA

- Easy to use app and online interface

Cons

- Their wealth management services are expensive as AUM

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak